Claim depreciation on outdoor structures and save

Australia is made for outdoor living, so it is little wonder that alfresco areas have become sought after additions in any property.

Owners see great value in adding permanent weatherproof structures to an investment property. Creating an indoor-outdoor environment which can be enjoyed all year round not only adds value to the existing property, but it can also help to attract tenants and potentially increase the annual rental yield.

What many investors don’t realise is that by adding an alfresco or an outdoor structure of any kind, they will also impact the depreciation deductions they can claim.

Any structures added to an investment property will entitle the owner to claim additional capital works deductions, also known as building write-off, at a rate of 2.5 per cent per year.

If the owner installs any new plant and equipment items, including removable or mechanical assets, this will also entitle the owner to claim depreciation deductions for these items. The deductions an owner can claim for any new plant and equipment items will be based on the individual effective life of each item as set by the Australian Taxation Office.

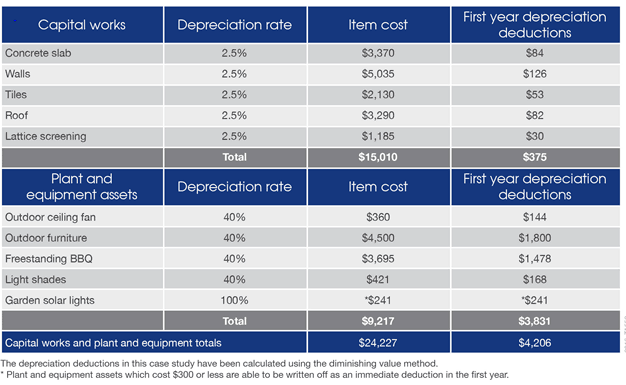

Let’s take a look at a scenario in which an investor decided to add a seven metre by four metre outdoor alfresco to their existing four bedroom investment property. The structural work on the alfresco cost $15,010. The owner also chose to install plant and equipment assets totalling $9,217 in value, bringing the total cost of work done to the property to $24,227.

Below is a summary of the costs of the new additions and the first full year depreciation deductions the owner could claim.

As the table shows, the owner of this property could claim $375 in capital works in the first full financial year deductions for structural items such as the concrete slab, walls, tiles, roof and lattice screening. The owner of the property would also be entitled to claim capital works for the remaining life of the property (forty years) for new structural items.

Plant and equipment assets installed such as an outdoor ceiling fan, outdoor furniture, a freestanding BBQ, light shades and garden solar lights resulted in a $3,831 deduction in the first full financial year for the property owner. This brought the total depreciation deduction of new items installed to $4,206 for the owner. These deductions would be in addition to any remaining depreciation deductions the owner could claim from the pre-existing property.

It is important to note, that if the property owner was to remove any existing structures or assets during the process of adding the alfresco area, they may also be entitled to additional deductions. If any remaining depreciation deductions exist for items or assets being removed during a renovation or addition, the property owner may be entitled to claim a deduction for the full amount of the remaining depreciation for items scrapped within the financial year of their removal.

Property owners should always seek the advice of a specialist Quantity Surveyor when they plan to make any alterations to their rental property. If the owner has an existing depreciation schedule they will need to have it updated and if assets or structures are being removed the Quantity Surveyor should perform a site inspection before and after work commences to ascertain the remaining depreciation of items being removed and value new structures and items added to update the depreciation schedule for the owner.

Investors can learn more about depreciation and what deductions they can claim by visiting the BMT Tax Depreciation overview page on their website. They can also seek obligation free advice from one of their expert staff by phoning 1300 728 726.

Article provided by BMT Tax Depreciation. Bradley Beer (B. Con. Mgt, AAIQS, MRICS, AVAA) is the Chief Executive Officer of BMT Tax Depreciation. Please contact 1300 728 726 or visit www.bmtqs.com.au for an Australia-wide service.